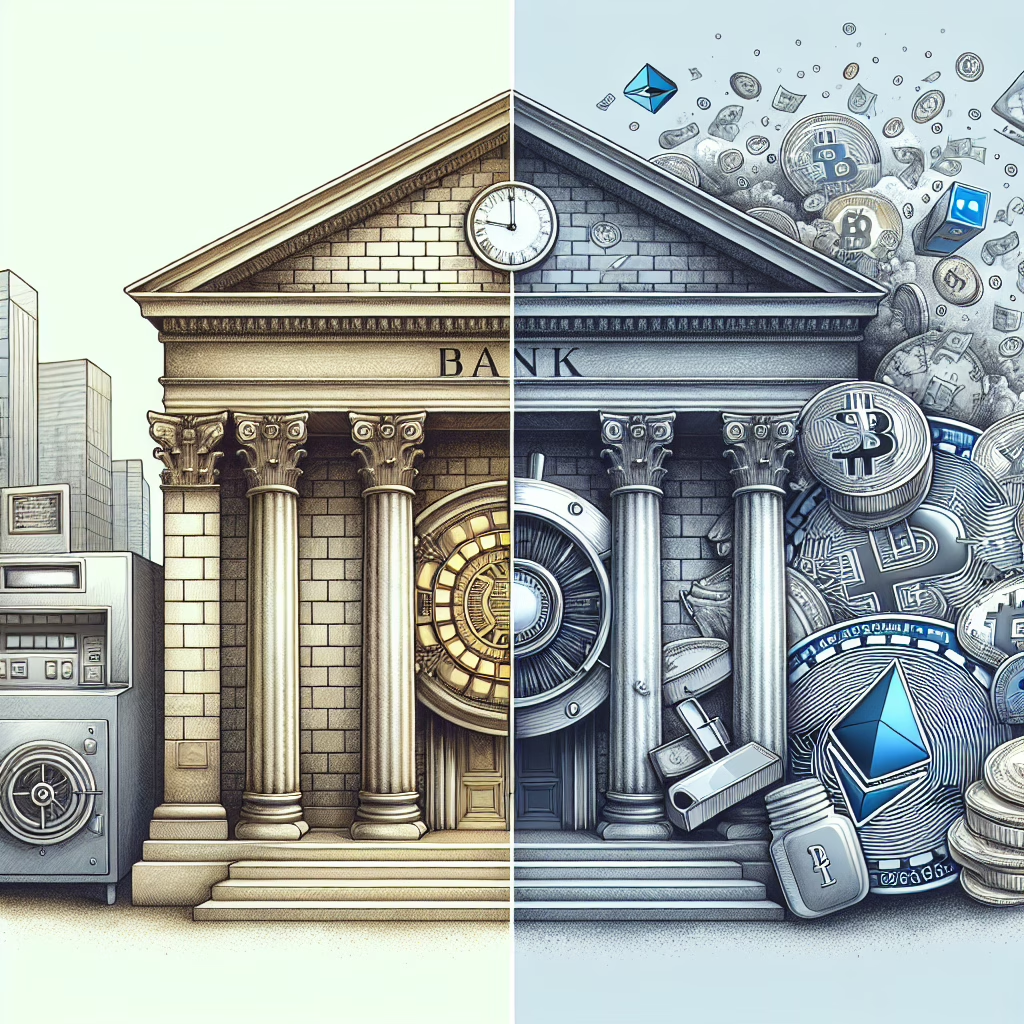

In a world where traditional finance and cryptocurrency are often seen as polar opposites, it’s refreshing to witness major players like State Street and Citi stepping into the crypto custody arena. This development is not just a trend; it’s a sign that the financial landscape is evolving, and the appetite for cryptocurrency is growing among institutional investors.

State Street, a stalwart in the financial services industry, has recently announced its commitment to expanding its crypto custody services. This move is a clear indication that they recognize the potential of digital assets and are eager to provide their clients with the tools they need to navigate this new frontier. After all, who wouldn’t want to be part of the next big thing?

Meanwhile, Citi is also making waves with its own crypto custody offerings. The bank’s foray into this space is a testament to the increasing acceptance of cryptocurrencies as a legitimate asset class. It’s almost as if they are saying, “Hey, we see you, crypto enthusiasts! We’re ready to play ball!” This newfound enthusiasm from traditional financial institutions is bound to inspire confidence among investors who have been hesitant to dip their toes into the crypto waters.

But what does this mean for the average investor? Well, it means that the barriers to entry are slowly being dismantled. With established institutions like State Street and Citi providing custody solutions, investors can feel more secure knowing that their digital assets are being managed by trusted entities. It’s like having a safety net while you explore the thrilling world of cryptocurrency.

Moreover, this shift towards crypto custody services is likely to attract more institutional investors into the market. As these financial giants embrace digital assets, it paves the way for greater legitimacy and stability within the crypto space. Institutional investment has the potential to drive prices up and create a more robust market, benefiting everyone involved.

Of course, it’s not all sunshine and rainbows. The crypto market is still rife with volatility, and investors must remain cautious. However, the involvement of major institutions like State Street and Citi can help mitigate some of these risks. Their expertise in risk management and compliance can provide a level of assurance that was previously lacking in the crypto space.

In conclusion, the growing appetite for crypto custody services among traditional financial institutions is a positive development for the cryptocurrency market. It signals a shift towards greater acceptance and integration of digital assets into mainstream finance. As we continue to witness this evolution, it’s essential for investors to stay informed and engaged. What are your thoughts on the increasing involvement of institutions in the crypto space? Are you feeling more confident about investing in digital assets? Share your views in the comments below!